What is Bounce?

Bounce is a Lloyd’s of London coverholder with a mission to help you build financial resilience to natural disasters.

We are providing low cost, quick pay earthquake insurance with the aim of getting more Kiwis protected. Bounce coverage is based simply on an earthquake exceeding the seismic trigger, your insured location and your experience of extra expenses, not time-consuming claims paperwork.

Here's how it works: You pay a low annual or monthly cost in premiums. If your insured location experiences earthquake shaking of a certain intensity (as set out in your policy), you simply reply to our text message to confirm that you've been affected. Subject to the terms and conditions of the policy being met, we then deposit your payment directly to your bank account, after only a few short days.

No paperwork, no deductible, no visit from an insurance assessor.

General

Conventional earthquake insurance is designed to cover significant loss, but Bounce is different. The Bounce insurance product is designed to support your financial resilience by assisting you with immediate cash flow for those expenses which you are unable to recover from other insurance policies. A Bounce cash payment following an insured earthquake event is paid in days and helps with any immediate financial losses or additional expenses that you may have as you start your journey towards recovery. A Bounce policy can be a useful complement to traditional insurance because it pays quickly, has no excess or deductible, and covers any extra expense, not just property damage.

You may use the payment for quake related losses or costs, such as:

- Living expenses and food.

- Deductibles from other insurance policies.

- Loss of income.

- Professional and technical advice.

- Mental wellbeing support.

- Replacing broken items.

- Moving costs and temporary accommodation.

- Child/elder care.

- Emergency home repairs.

- Clean up and property security.

The only things not covered are losses already paid by other insurance, and losses due to bodily harm. Oh, and earthquakes caused by nuclear explosions, cyber attacks, wars and terrorist attacks. (Seriously.) Other than that, you're the one who will best know your needs—the payment is yours to spend as you need to recover.

No. Each payment is deposited directly into your bank account.

Yes, we offer a couple of options for individuals with sum insured values of $10K and $20K available. We offer a slightly wider range of options for Business customers with sum insured values of $10K, $20K and $50K being available.

That said, every adult (18+) at a given location can buy a policy. Businesses can buy a policy for up to $50k of coverage. This includes home-based businesses.

New Zealand has had 7 significant earthquakes in the past decade. The next Big One in New Zealand isn't a matter of "if" but "when".

Research by GNS Science has found that the 2016 Kaikoura quake has “loaded” the Wairarapa fault line and this could result in a major quake. Researchers have also found that the massive Alpine Fault is due for another big earthquake, and similarly, the likelihood of a rupture of Hikurangi fault line is increasing. Finally, in their forecasting, GeoNet think that the probability of a magnitude 5.0-5.9 occurring in Canterbury is 38%, and there is a 34% probability of a magnitude 6.0-6.9 occurring in the Kaikoura region.

So why buy earthquake insurance?

The first reason is to be prudent. While New Zealand has the fourth highest insurance penetration in the world, we still have an underinsurance problem. Most kiwis are not insured for the full cost to replace their house or contents and if disaster strikes this leaves them vulnerable. Things like shared walls, retaining walls, shared boundaries and access ways, and multi-use buildings also adds to the complexity of claim resolution.

Secondly, our product is designed to provide a quick payment to our customers to help our policy holders with any immediate financial losses or costs resulting from an earthquake. Due to the complexity and sheer scale of a major earthquake, the claims response and timing of settlement from your traditional insurer could take some time to come through.

When there's more money in the local economy, we all recover more quickly.

Availability

Yes. Bounce is available to both renters and homeowners. Bounce maybe attractive to renters because the payment covers any extra expense, not just damage to your contents—relocation expenses, daycare—whatever you need.

Yes. Bounce is available to both homeowners and renters. Bounce maybe attractive to homeowners because it can provide a quick cash infusion after a quake for whatever they need to recover—whether it's emergency property repair, daycare, or anything else. Bounce will complement your existing insurance by boosting your financial resilience.

Yes. Any business or non-profit can obtain a policy for each location that it owns or operates. A business can choose $10,000, $20,000, or $50,000 of coverage. This helps cover the financial gap caused by slow responding business interruption policies and those holding relatively high excesses on traditional commercial policies.

Yes. You can purchase Bounce for any locations that you live in or own.

Yes. The person paying the premium can be different from the person receiving the payment.

Yes.

Yes. Bounce can be purchased as additional coverage for someone who already has a traditional insurance policy. A Bounce policy can be a valuable complement to conventional house and contents insurance because it pays quickly, has no deductible, and covers any extra expense, not just property damage.

Claims/Payments

Bounce is committed to complying with the Fair Insurance Code as published by the Insurance Council of New Zealand.

This means we will:

- provide insurance contracts which are understandable and show the legal rights and obligations of both us and you;

- explain the meaning of legal or technical words or phrases;

- explain the special meanings of words or phrases as they apply in the policy;

- manage claims quickly, fairly and transparently;

- clearly explain the reason(s) why a claim has been declined; and

- provide you with a written summary of our complaints procedure as soon as disputes arise and advise you how to lodge a complaint and tell you about the Insurance and Financial Services Ombudsman Scheme.

You can access a copy of the code here.

The intent of this policy is to cover financial losses and extra expenses resulting from an earthquake that exceeds the seismic trigger.

To ensure fast, fair payments, we use seismic data from GeoNet. This data allows us to objectively identify areas where customers are highly likely to have extra costs as the result of a quake.

Payment eligibility is based on shaking intensity. If your location is subject to shaking with a Peak Ground Velocity (PGV) of at least 20 centimetres per second due to the earthquake event, then you are eligible to receive payment.

To ensure responsive cover we apply a stepped payment. If shaking is equal to or greater than 20cm/sec but less than 25cm then we pay 10%, if the shaking is 25cm/sec but less than 30cm then we pay 40%, and if the shaking is 30cm/sec or greater then we pay 100% of sum insured amount.

In New Zealand, our PGV threshold of 20cm/sec corresponds to a Modified Mercalli Intensity (MMI) of VII, and this is catagorised by GeoNet as a "Severe" earthquake. A severe earthquake is where people have difficulty standing, furniture moves, there is substantial damage to objects, and a few weak buildings are damaged.

We recognise that earthquake events are complex systems and can result in a wide range of unexpected outcomes. We have applied a stepped-payout approach to helping you recover from an earthquake event based on the sum insured which is shown on your schedule. The amount that we will pay you following an earthquake will be calculated as follows:

| Highest PGV measured at your nearest GeoNet sensor at any time during the earthquake event: | Less than 20cm/sec | Equal to or greater than 20cm/sec, but less than 25cm/sec | Equal to or greater than 25cm/sec, but less than 30cm/sec | 30cm/sec or higher |

| The amount we will pay to you as a percentage of the sum insured shown on your schedule: | 0% | 10% | 40% | 100% |

Analysis of past earthquakes highlights that our policy would have responded and provided comprehensive payouts in all the major earthquakes experienced by New Zealand over the past decade.

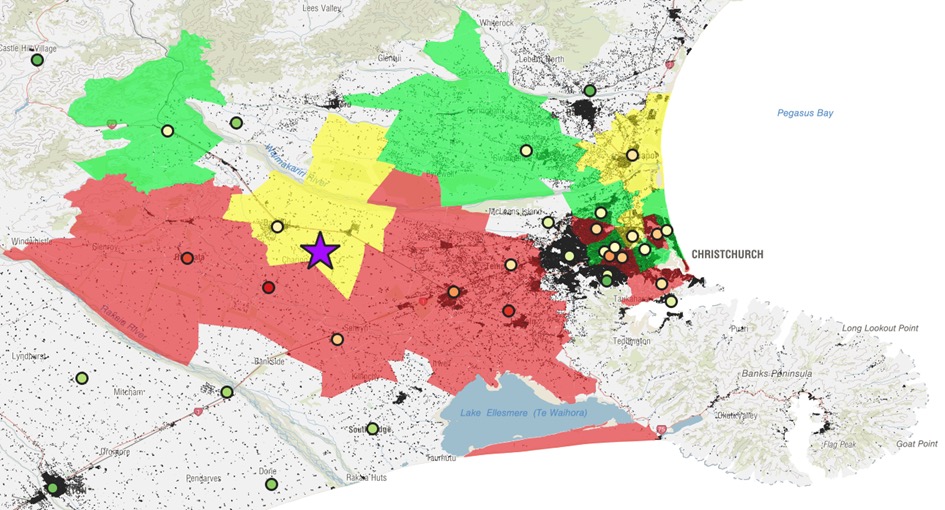

Darfield Earthquake, 4 September 2010: This quake occurred at a depth of 11km (shallow) with a magnitude of 7.2, a velocity (PGV) of 94.5cm/s, and a MMI rating of X (Extreme). This caused widespread destruction of buildings, substantial displacement of land, and significant disruption. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers in this event.

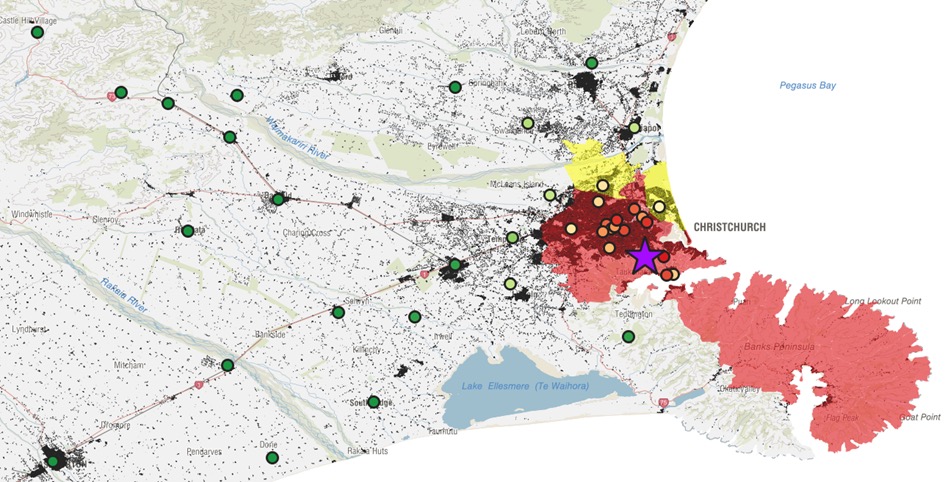

Lyttleton Earthquake, 22 February 2011: This quake occurred at a depth of 6km (shallow) with a magnitude of 6.2, a velocity (PGV) of 97.3cm/s, and MMI rating of VIII (Extreme). This caused widespread destruction of buildings, substantial displacement of land, and significant disruption. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers in this event.

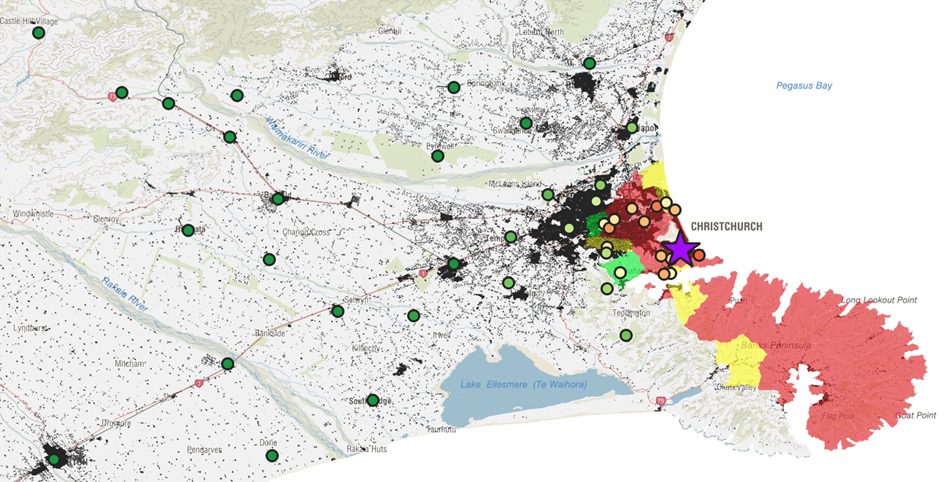

S.E Christchurch Earthquake, 13 June 2011: This quake occurred at a depth of 7km (shallow) with a magnitude of 6.0, a velocity (PGV) of 95.6cm/s, and an MMI rating of VIII (Extreme). This caused further destruction of buildings, some displacement of land, and further disruption. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers in this event.

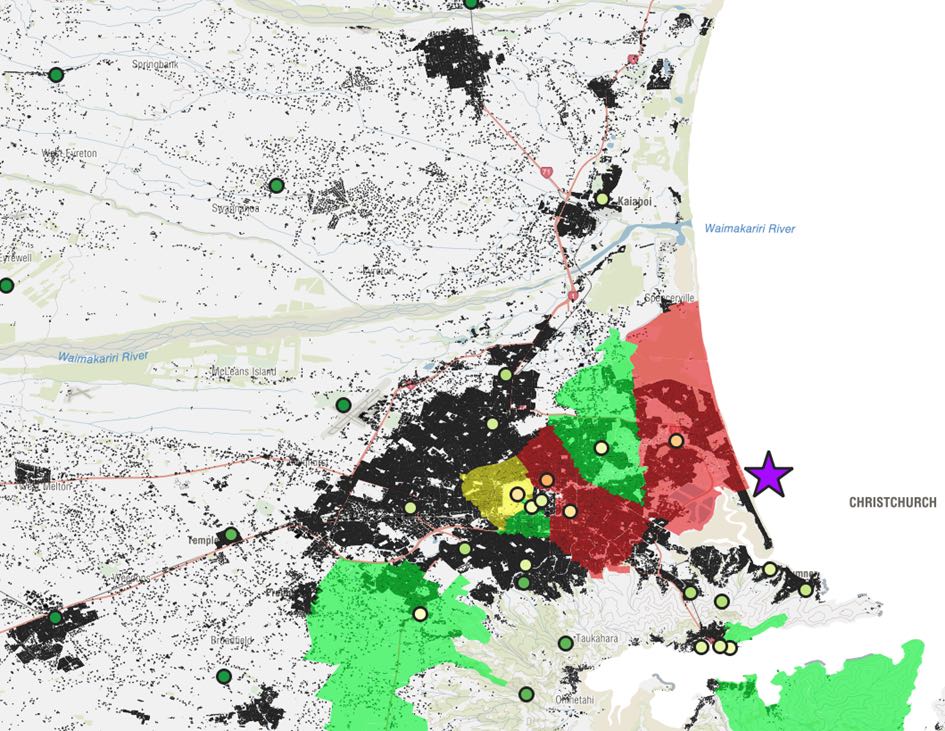

East Christchurch Earthquake, 23 December 2011: This quake occurred at a depth of 6km (shallow) with a magnitude of 5.8, a velocity (PGV) of 49.6cm/s, and an MMI rating of VIII (Extreme). The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers in this event.

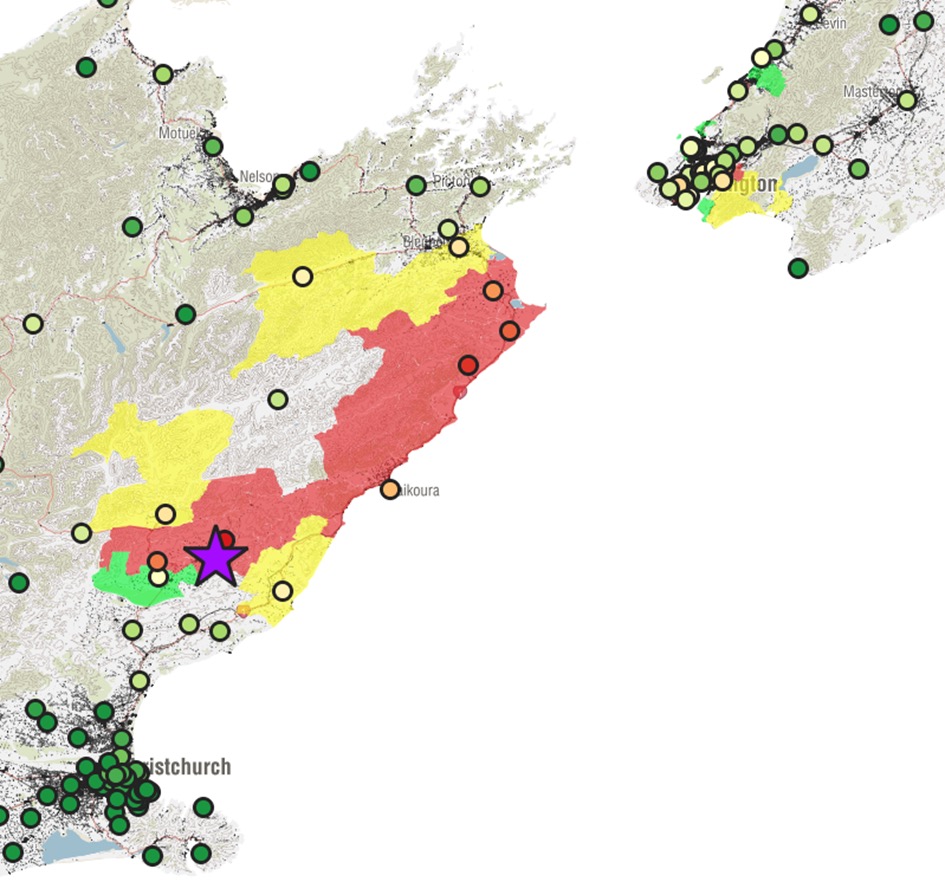

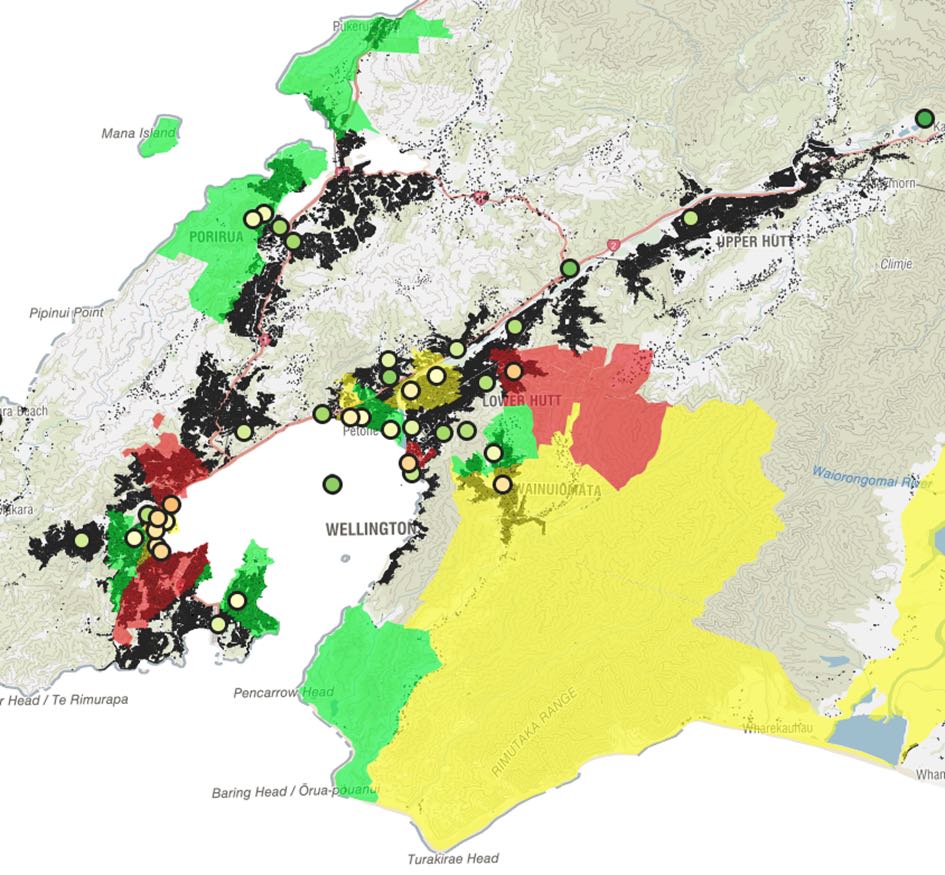

The Kaikoura Earthquake, 13 November 2016: This quake occurred at a depth of 15km (shallow) with a magnitude of 7.8, a velocity (PGV) of 101.7cm/s, and an MMI rating of IX (Extreme). This caused widespread destruction of buildings, substantial displacement of land, and significant disruption through the Canterbury region, Marlborough region, and the Wellington region. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers in this event.

The map below provides a more granular view of policy response in Wellington region as a result of the Kaikoura Earthquake.

Our policy responds to earthquakes with movement of at least 20 centimetres per second. This is equivalent to a “Strong” to “Severe” earthquake when compared against the GeoNet Simplified New Zealand MMI Scale.

A strong earthquake is felt by all. People and animals are alarmed, and many run outside. Walking steadily is difficult. Furniture and appliances may move on smooth surfaces, and objects fall from walls and shelves. Glassware and crockery break. Slight non-structural damage to buildings may occur.

A severe earthquake causes general alarm. People experience difficulty standing. Furniture and appliances are shifted. Substantial damage to fragile or unsecured objects. A few weak buildings are damaged.

Refer to GeoNet for more information.

To ensure fast, fair payments, we use data from GeoNet / GNS Science—the New Zealand government agency responsible for measuring earthquakes. Using GeoNet data allows us to objectively identify areas where customers are highly likely to have extra costs as the result of a quake.

A quake with movement of 20 cm/sec is the point where there is likely to be some damage and extra costs because of a quake.

Using magnitude is quite localised and alone would exclude soft soil areas that are far away from the earthquake epicenter, but nevertheless could experience intense shaking. Using PGV makes sure areas like this get included for payment eligibility.

The claim management process is activated by a notification from GeoNet strong motion sensors.

After an earthquake occurs, if your location experiences the triggering shaking intensity, we send you a text message that tells you that “You’re eligible to a claim payment”.

To receive a payment, you must complete the Loss Declaration procedure by responding to text messages initiated by us or by contacting us directly. To facilitate the Loss Declaration process, we will send you a text message to confirm that:

- You own, reside or work at the insured address; and

- You have suffered a covered loss as a result of the earthquake; and

- To the best of your knowledge and belief the covered loss will be at least equal to the amount that we pay you.

After you respond affirmatively, we initiate payment. We use text messaging because it's likely to be the first form of communication to start working after a disaster.

If you are unable to complete the Loss Declaration because you do not believe that your loss and extra expenses will be equal to or more than the amount that we will pay you then please contact Bounce by emailing us (support@bounceinsurance.co.nz) or calling us (0508 268623). We will arrange a partial payment of the amount that you expect to incur based on your knowledge and belief at the time. If your loss turns out to be more, then we will simply make additional payments up to the maximum of your entitlement.

You can also provide your affirmative response by calling us (0508 268623); emailing us (support@bounceinsurance.co.nz); by logging into your account; or through Facebook messenger.

No. When you are eligible for payment and respond affirmatively to our Loss Declaration process that to the best of your knowledge and belief you expect your loss and additional expenses to be at least the value of our payment to you, then we authorise the payment.

We do request that you keep any relevant receipts as evidence that funds were spent on your earthquake recovery.

Earthquakes big enough to trigger payments will also be big enough to cause all sorts of unanticipated expenses, some of which won't become apparent until much later.

The policy (and the cover amount) has not been designed to insure people against all losses they may suffer due to an earthquake. Based on our statistical analysis, we chose a payment amount that's typically a fraction of what most people will need.

However, if your expenses and losses are less than the amount that we have paid you then please contact us to discuss. We may request that you return the excess funds to us if it is obvious that all your additional expenses and losses will not reach the amount paid.

Your traditional house and contents insurance policies are designed to cover significant loss, but Bounce is different. The Bounce insurance product is designed to support your financial resilience by assisting you with immediate cash flow for those expenses which you are unable to recover from other insurance policies. A Bounce cash payment following an insured earthquake event is paid in days and helps with any immediate financial losses or additional expenses that you may have as you start your journey towards recovery. A Bounce policy does not replace or duplicate the cover provided by other policies, but rather can be a useful complement to traditional insurance because it pays quickly, has no excess or deductible, and covers any extra expense, not just property damage.

- Payment eligibility is based on shaking intensity.

- Specifically, if your location is subject to shaking with a Peak Ground Velocity (PGV) of at least 20 centimetres per second due to the earthquake event, as determined on the basis of data from the nearest GeoNet strong motion sensor, then you are eligible to file a claim.

- Data used to define payment eligibility are as reported by GeoNet usually within 24 hours after occurrence.

- You are entitled to claim for more than one earthquake event which may occur during the policy period, but the absolute maximum we will pay you for all earthquake events is the Sum Insured shown on your schedule.

See full policy for detailed terms.

Our Team

Bounce was founded in 2020 by Paul Barton. Paul comes from an insurance background and has spent years working with claim teams and customers impacted by earthquake events in New Zealand. Paul saw the financial hardship and stress that Kiwis faced when trying to re-build their lives after a severe earthquake. This prompted Paul to think about a smarter way for insurance to be more responsive to the needs of Kiwis after an earthquake. Bounce is based on the belief that quick recovery is key to mitigate financial hardship and minimise emotional stress for individuals and their families, and the wider community. From this belief Bounce was formed with a focus on promoting individual, and community recovery, by paying claims within days of an earthquake event.

Today we are a small team of highly committed specialists.

Bounce’s mission is "to increase economic stimulus following an earthquake.” Basically, we're trying to get more money flowing into our communities when we need it most.

Bounce exists to provide Kiwis with a financial boost after an earthquake. We created Bounce for Kiwis impacted by an earthquake because we saw that there is often a lag between the earthquake event and when the insurance payout is made and this creates financial hardship and emotional stress.

Bounce is a Lloyd’s of London coverholder and holds a binding authority agreement to provide earthquake insurance policies to New Zealand.

The good news for policy holders is that their policy is 100% underwritten at Lloyd’s of London (by the Lloyd’s Syndicate 1840).

Lloyd’s is the world’s leading insurance and reinsurance marketplace. Through the collective intelligence and risk-sharing expertise of the market’s underwriters and brokers, Lloyd’s helps to create a braver world.

The Lloyd’s market provides the leadership and insight to anticipate and understand risk, and the knowledge to develop relevant, new and innovative forms of insurance for customers globally.

It offers the efficiencies of shared resources and services in a marketplace that covers and shares risks from more than 200 territories, in any industry, at any scale.

And it promises a trusted, enduring partnership built on the confidence that Lloyd’s protects what matters most: helping people, businesses and communities to recover in times of need.

Lloyd’s began with a few courageous entrepreneurs in a coffee shop. Three centuries later, the Lloyd’s market continues that proud tradition, sharing risk in order to protect, build resilience and inspire courage everywhere.

For information on the financial strength ratings of Lloyd’s, please click here.

For more information on Lloyd’s, visit www.lloyds.com.

As a Coverholder for Lloyd’s of London, Bounce benefits from a partnership with Lloyds through Lloyd’s Syndicate 1840. Lloyd’s syndicates benefit from Lloyd’s brand and ratings, its network of global insurance licences, and its central fund, which is available at the discretion of the Council of Lloyd’s to meet any valid claim that cannot be met by the resources of the member. As all Lloyd’s policies are ultimately backed by this common security, a single market rating can be applied. For information on the financial strength ratings of Lloyd’s, please click here.

Support

See full policy for detailed terms.

We email your electronic policy when you sign up and again each year. In addition, it's available in your account status. Simply log in. From there, you can print out a PDF if you need a paper copy.

Unless you tell us otherwise, your policy will renew with no action required from you. We will send you an annual reminder that your policy will renew.

You can cancel at any time with no penalty. Simply call us at 0508 268623 or click on the Chat box at the bottom right corner of this page. We will cancel your policy that day and issue a pro-rated refund.

Click on the Chat box at the bottom right corner of this page, or email us at support@bounceinsurance.co.nz and we'll respond quickly.

We use the strongest browser encryption available, and store all of our data on servers in a secure facility.

We protect the privacy of your information and will never share your data with any third party without your permission. For more information, please review our privacy policy.

The information on this website is of a general nature only and provides a summary of the main features of the Bounce Insurance policy. It does not take account of your personal situation or goals. Before you decide to take out a Bounce insurance policy you should consider if the product suits your needs by reading the policy wording, and seek independent financial advice if you are unsure.

© 2025 Bounce Insurance Limited, FSP 749731